Your business, your car, and blind driving!

Your business, your car, and blind driving!

In an ASIC recent review of externally administered companies for financial year 2015/16 it has been found that external administrators lodged 9,465 reports to ASIC citing the major causes of failure as:

- Inadequate cash flow or high cash use in (4,318 or 46% of reports)

- Poor strategic management of business (4,315 or 46% of reports); and

- Poor financial control including lack of records (3,183 or 34% of reports)

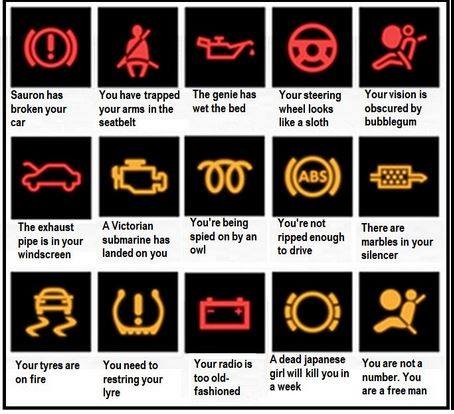

Imagine some or all the gadgets in your car’s dashboard are not working properly, chances are will run into troubles soon enough, you may run out of fuel, or your car may get overheated, I am sure in a situation like this will head straight to you technician to get the gadgets fixed, so you would be able to monitor the state of your vehicle while driving, these gadgets are essential for safe driving as they collect data and demonstrate it in a simple way, and when necessary prompt the driver to act.

In business, proper bookkeeping is doing exactly that; accurately gathering data and make it available to the decision makers so they can act and strategically position the business for success. Bookkeeping is not and shouldn’t be a compliance burden. It is the only tool that could be used to drive your business success, by dashboarding accurately collected data you will be able to answer questions like;

· What could be done to improve “The Bottom Line”?

· Who are our most profitable clients?

· What parts of our business is more profitable than others?

· How could we improve our cashflow?

At The Bottom Line Business Advisory, we believe that bookkeeping is vital for small businesses survival, that’s why we have decided to keep our focus on supporting SMEs in keeping proper records to maintain appropriate financial control.

You can’t build a house without a foundation, and you can’t grow a business without good bookkeeping systems.

We measure the success of our business by the improvements in our client’s bottom line. We focus on what matters and believe that changing simple things can make a huge difference.

Featured Articles

Key information on work from home deductions…

Fixed Rate For the 2023–24 income year, you can claim 67 cents per hour for working from home. This rate …

Starting a business? You’ll need to choose a business structure…

If you are starting a business, it’s important to choose the right business structure to suit your needs. As your …

Reducing capital gains tax

Did you know you can reduce your capital gains tax (CGT) bill by offsetting your capital gains with capital losses? …

Bookkeeping for small businesses

Why Bookkeeping Matters for Small Businesses: Organizing Information: Bookkeeping helps organize financial data, making it easier to understand and analyze. …

Growing your superannuation

Personal Super Contributions: You can boost your super by adding your own personal contributions directly to your super fund. If …

Lodging your tax return

A tax return is a document you submit to the tax authorities (such as the Australian Taxation Office, ATO) that …

Own an investment property? Implement this from the get-go to make taxation easier…

Don’t make the mistake of going into an investment without thinking about taxation. Let’s say your property is being used …