Developing an Investment Plan

Developing an Investment Plan

Are you ready to take control of your financial future? Discover how to craft an investment plan that can pave the way to wealth and prosperity.

Review your finances

Before investing, it’s important to review your financial situation. Assess your debts, assets, income, and expenses to understand where you stand.

Moneysmart’s net worth calculator and budget planner can help to track and record these.

This will help you find out how much you can invest regularly, and how much of your savings can be invested.

Set financial goals

Write down your goals, that include a specific amount of money, and the time period in which you aim to reach it.

Categorise them into short term (0-2 years), medium term (3-5 years) or long term goals (5+ years).

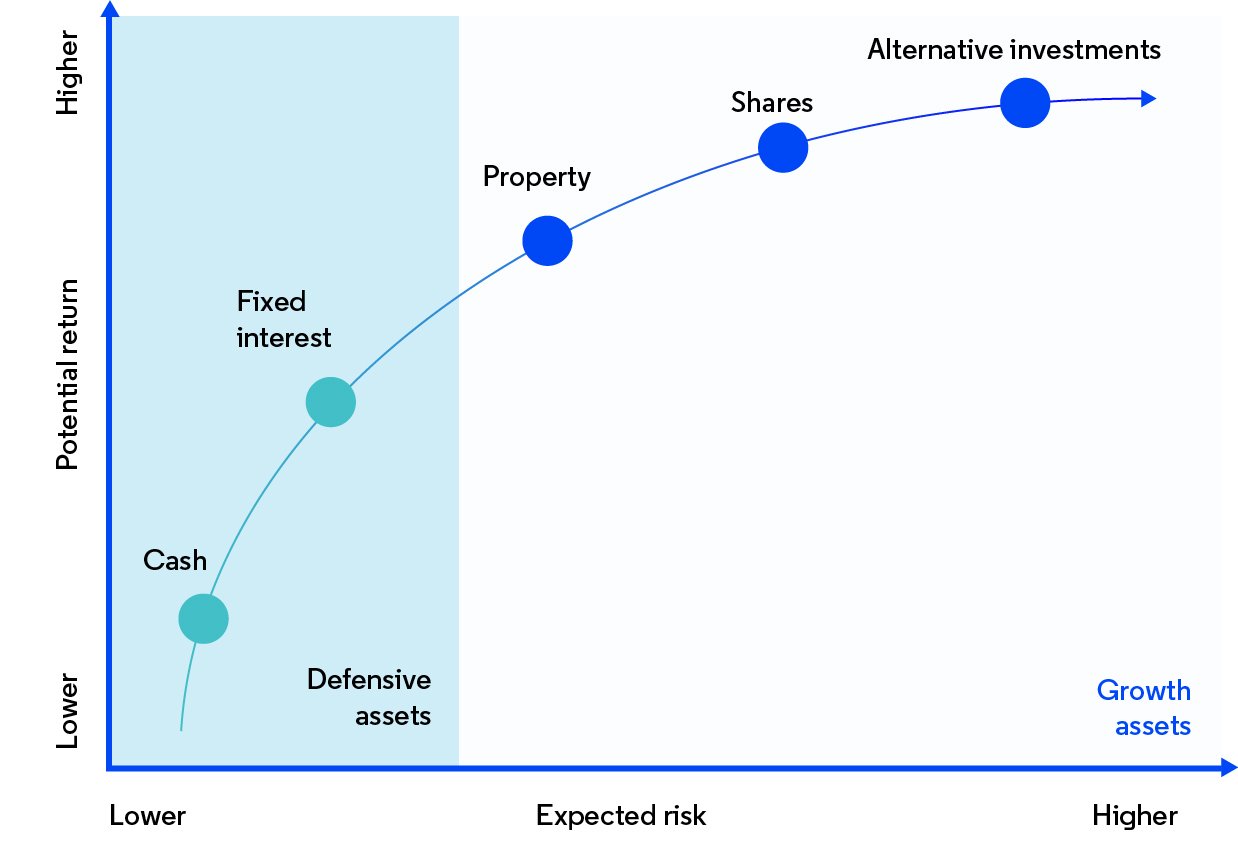

Understand risks involved

Take some time to understand the risk factors involved that could impact the value of investments.

Usually, higher risks come with higher returns.

Evaluate your risk tolerance, which depends on how well you can cope with your investment falling in value.

A good question to ask is “How would I feel if I woke up tomorrow and found the value of my investments had dropped 20%?”. If this would be alarming, and you would withdraw your money, high risk investments may not be suitable.

Research investment options

When seeking the perfect investments, consider crucial factors such as the anticipated return, investment duration, risk tolerance, liquidity, transaction costs, and tax implications. By carefully analyzing these elements, you can align your investment choices with your financial goals and pave the way for optimal returns.

For an overview of various types of investments, check out Moneysmart’s pages.

Build a portfolio

If you have shorter term goals, low-risk investments are a better idea. However, if you have longer term goals, high-risk investments like shares can be better. Despite the short-term loss in value these can have, you can get past them if you’re in it for the long run.

Make sure to diversify your portfolio in different types of assets and areas within each of those types. This means if one of them falls in value, you will have a layer of protection.

Keep track of investments

Monitor the state and value of your investments regularly, to check if you’re on track to achieving your financial goals.

Learn more at moneysmart.gov.au

Featured Articles

GST food classification resources

The ATO has issued guidance and resources to help businesses determine the GST classification of food and non-alcoholic beverages. This …

Lifestyle Assets Data-Matching Program

We want to keep you informed about important developments from the Australian Taxation Office (ATO). Starting from the 2023-24 financial …

Considering Your First Home? Explore the FHSS Scheme

The First Home Super Saver (FHSS) scheme allows you to make voluntary contributions to your super fund to assist in …

Downsizer super contributions

If you’re 55 years or older and have recently sold (or partially sold) your home, you could be eligible to …

Best practices for storing records

As we enter the new financial year, it’s crucial to stay organized with your financial records. The Australian Taxation Office …

Do you receive benefits through a business?

This may come with tax implications, so here are some quick tips to keep things straightforward and avoid tax hassles: …

Did you know about the tax incentives for early stage investors?

If you invest in a qualifying early stage innovation company (ESIC) from 1 July 2016, you might be eligible for …